Table of Contents

Online document verification ensures the validity of current documents and helps to reduce the risk of violations in the finance sector. Monitored and regulated industries such as banks have crucial systems as rules are stringent here.

By verifying documents online, organizations can minimize the fraud risk and ensure they have all the essential rules and regulations. However, it is about more than meeting the laws; id document verification also assists in building trust between clients and companies.

According to Statista, the market value of document verification services has risen from 3.50$ Billion in 2017 to 6.78$ Billion in 2023.

Online Document Verification Challenges

1. Diverse Documents

Companies use more than 6,000 document types for ID verification on average. To verify a user’s existence companies use the following information.

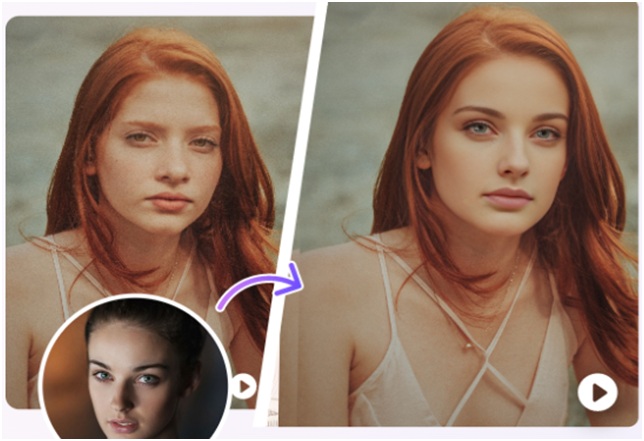

- Identity picture

- The available data on the username

And any other information saved in the document to verify user identity. Furthermore, data is checked for credibility after extraction.

2. Issues in Protecting Accuracy of Document Verification

Keeping a solid user base and maintaining a reputation as a trustworthy document verification service provider relies on instant, accurate, and client-friendly verifications. A suggestion for these service providers is to provide assurance by engaging a large audience. So, fraud safety is crucial and must be protected by document verification services. Ongoing monitoring inspections can also be utilized to investigate current users for authenticity and reliability.

3. Maintain a Positive User Experience

To maintain client experience, training employees on how to verify documents is vital. This helps create a positive user experience as only some clients are more concerned with secure or precise processes.

4. Privacy, Data Security, and Trust

Privacy is vital for services dependent solely on user biometric or biographic data. Customers should know that their information is kept, controlled, and secured. Moreover, financial companies and banks must give users control over their information.

Few Use Cases of Online Document Verification

1. Avoid Fraudulent Activities

Verifying documents online helps reduce fraud by recognizing suspected criminals before they can do any wrong. Outdated data or any other illegal activity can instantly show concerns that need more investigation. Comparing different data pieces, fraud flash, and sources raises the standard for cybercriminals, which they can’t meet. Moreover, depending on the threat mitigation plan, a segmented technique for identity verification can further reduce the fraud rate.

2. Achieve Compliance

Compliance standards ensure firms have techniques to safeguard themselves against financial crimes such as terrorist financing and money laundering. In a few cases, acquiring compliance demands authenticating business clients. Document checker understands that the data used to make an account is real. Then, they compare the information against trusted and reputable references to tell the company about its user’s details. These details include who the users are, allowing them to satisfy compliance requirements and control administrative fines.

3. Improve Internet Safety and Trust

With the help of online document verification services, individuals can trust outsiders in different markets. Hence, protecting companies and customers is the primary feature of document verification companies.

4. Fraud Detection

Document verification helps businesses identify and mitigate fraud types, such as phishing attempts, account creation fraud, and phishing attempts.

5. Age Verification

Organizations that deal in the service of age-restricted services or goods usually leverage document verification to verify the new user’s age. These services or goods include alcohol, online gambling, tobacco, adult entertainment, and prescription drugs.

6. Account Opening

Many organizations leverage document verification as a method of their account opening and customer onboarding techniques. Digital health companies, financial institutions, online dating websites, and social media are some firms that usually need document verification.

7. Vendor Verification

When a company begins working with a new client, document verification is critical to ensuring that the vendor is authentic. It also plays a vital role in meeting KYB regulations.

8. AML and KYC Compliance

Document verification is usually an essential piece of the verification puzzle for companies subject to AML/KYC rules.

Also Read: How Applicant Tracking System Foster Connected Recruiting?

Conclusion

Artificial intelligence and machine learning play a vital role in the future of fraud protection and document verification. Organizations can quickly secure the identities of their users from cyber attacks. Improving the online document verification security and speeding up customer onboarding by reducing scamming activities.

Moreover, online document verification investigates the documents that individuals upload. It is an essential stage in identifying forgeries and reducing fraudulent activities. Scammers easily open a new account without a document check using stolen information.